Preparing for the 2025 annual report: New accounting requirements and the transition to IFRS 18

This spring, just as many Swedish listed companies were publishing their annual reports, the International Accounting Standards Board (IASB) issued several updates to IFRS, including the new standard IFRS 18.

As many companies now once again begin preparing their annual reports, we at AVA would like to take the opportunity to review the changes and what listed companies need to keep in mind ahead of the 2025 reporting season.

IASB, which issues the IFRS accounting standards, continuously publishes corrections and amendments to the framework, in addition to the annual improvements, which usually consist only of minor clarifications. All listed companies on Nasdaq Stockholm’s main list report under IFRS and in the previous year, the financial year 2024, amendments were made to two standards: IFRS 7 and IFRS 16, dealing with disclosures regarding financial instruments and lease agreements respectively, as well as to IAS 1, which is a comprehensive standard setting out how financial statements are to be presented.

Changes effective in 2025

As of financial years beginning in 2025, amendments to IAS 21 take effect concerning situations where a currency is not freely exchangeable (“Lack of Exchangeability”). The new rules clarify how companies should determine an exchange rate when official rates do not reflect actual economic conditions or capital availability due to capital controls or other restrictions, and how this should be reported. A clear example is Argentina, where the official peso rate against USD has long deviated sharply from the parallel “dólar blue” rate, which will now be captured by the new rules.

IFRS 18 replaces IAS 1 in 2027

One of the most significant upcoming changes is the introduction of IFRS 18, which replaces IAS 1 Presentation of Financial Statements. The IAS standards are the older international accounting standards and are gradually being replaced by IFRS, though many IAS standards are still applied within the IFRS framework.

Like IAS 1, IFRS 18 addresses the presentation of financial statements. The current requirements in IAS will largely also be included in the new IFRS standard. In addition, IFRS 18 introduces a number of new disclosure requirements intended to give investors better opportunities to analyse and compare companies. Early application is permitted, meaning that companies wishing to be ahead of the curve can already apply the new standard in their 2025 annual reports.

The new disclosure requirements are as follows:

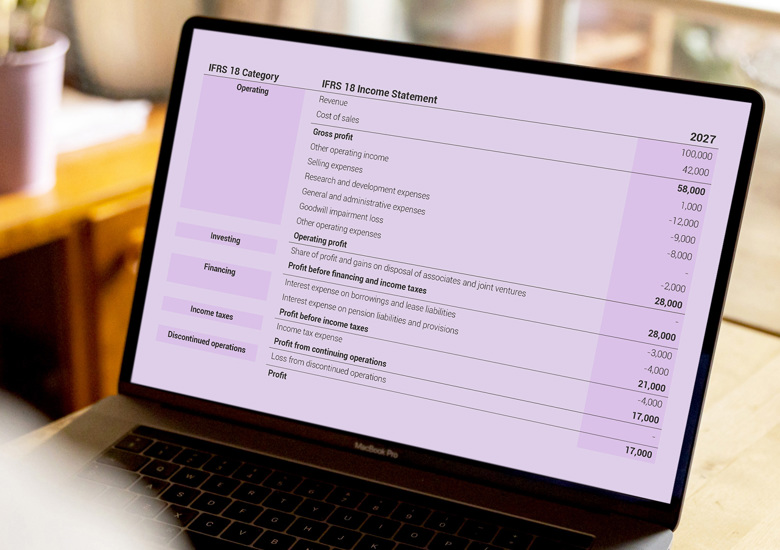

- New structure for the income statement. All items in the income statement must be classified into five categories: operating, investing, financing, income taxes, and discontinued operations.

- New subtotals in the income statement. Two new subtotals must be included in the income statement: Operating profit and Profit before financing and income taxes. The calculation of these subtotals is also defined in IFRS 18. Previously, companies had considerable freedom in calculating, for example, operating profit, which is already frequently reported by many companies. According to IASB, two out of three companies already report operating profit in their income statement today, but among the companies surveyed there were nine different methods for how it was calculated.

- Review of alternative performance measures. Alternative performance measures and other non-IFRS metrics reported outside of the financial statements to communicate the company’s financial position will now be classified as management-defined performance measures (MPMs) and be subject to review. This also means that definitions of these must be included. All metrics and definitions must be presented in a single note, with disclosure requirements for each metric including both the calculation method and a reconciliation against the most comparable IFRS-defined metric. For example, EBIT or adjusted operating profit must be reconciled with operating profit as defined in IFRS 18.

- More detailed disclosure requirements. New and stricter requirements regarding naming, aggregation, and disaggregation of items. This is partly linked to revenues and expenses being divided into five categories, and partly to where certain information should be presented (in the financial statements or in the notes). Some companies will also need to classify what constitutes their main business activity to enable correct reporting. This applies, for example, to companies in the financial sector that lend or invest money on behalf of clients.

- Consequences for the cash flow statement. With the introduction of IFRS 18, changes are also made to IAS 7 (Statement of Cash Flows) to strengthen the link between the income statement and cash flow statement. For example, the starting point for cash flow from operating activities must correspond to operating profit under the indirect method. Interest expenses and dividends must also be presented consistently across the two statements, meaning the flexibility that previously existed in classifying these items in the cash flow statement is removed.

- Further consequences. IAS 33 Earnings per Share is also slightly stricter in connection with IFRS 18, affecting the calculation of this key ratio. The numerator (the profit) must either correspond to profit attributable to the parent company’s shareholders, total comprehensive income, or a subtotal as defined by IFRS 18. A final option is to use an adjusted performance measure, but this must be disclosed in accordance with the new rules on MPMs. In addition, some disclosure requirements in IAS 1 are moved to IAS 8 Accounting Policies, Changes in Accounting Estimates and Errors, which will also be renamed IAS 8 Basis of Preparation of Financial Statements, and IAS 34 Interim Financial Reporting will also include disclosure requirements for alternative performance measures (MPMs).

Further changes in 2026–2027

In addition to IFRS 18, a number of changes are planned for upcoming reporting periods. From financial years beginning in 2026, amendments to IFRS 9 and IFRS 7 regarding the classification and measurement of financial instruments will take effect. The purpose is to clarify the application of the SPPI test, particularly for instruments with sustainability-linked features (“green" loans and bonds), as well as to create more consistent practice for derecognition and modifications. New disclosure requirements in IFRS 7 will also increase transparency on how ESG-related terms affect cash flows and risk exposure.

Related to this are further changes concerning companies that purchase nature-dependent electricity (such as wind and solar power) via power purchase agreements (PPAs) with terms dependent on actual energy availability. The new rules aim to better reflect the economic substance of such contracts and reduce the artificial impact on results that can arise when PPAs are classified as financial instruments. A key feature is the introduction of a criterion to determine whether the company is a net purchaser of electricity, which in turn determines when the own-use exemption applies. Overall, this may mean that more contracts going forward can be reported as commodity flows rather than derivatives.

IFRS 19 Subsidiaries without Public Accountability: Disclosures also comes into effect for financial years beginning in 2027 and, unlike IFRS 18, applies only to subsidiaries that are not listed or financial institutions, but that apply IFRS in order to be consolidated. IFRS 19 requires these companies to use the same recognition and measurement principles as in full IFRS, but with simplified disclosure requirements in the notes. The purpose is to reduce complexity and costs for unlisted subsidiaries, while ensuring the parent company still receives the information required for consolidated reporting.

Plan ahead

Preparing an annual report is a complex process, and for companies that want to be ahead of the curve, the work often starts 6–9 months before the publication date. For financial reporting, it is important to be prepared, especially if early application is planned for standards such as IFRS 18, or if companies intend to review their accounting policies or restructure their notes.

AVA Corporate Communications is a leading agency in financial communication, IR, and sustainability reporting. We support listed companies with everything from developing reporting processes to graphic design and production. If you have questions or considerations regarding upcoming IFRS changes, your annual report, or other reporting matters, do not hesitate to contact us.

Get in touch

Our strategic advisors and consultants help our clients manage complex challenges and create lasting value over time.